Measure A Sales Tax Revenue Bonds

Get Issuer Alerts

Add this issuer to your watchlist to get alerts about important updates.

Measure A Sales Tax Revenue Bonds

Overview

STA was founded in 1988 when Sacramento County voters approved Measure A, a half-cent sales tax for transportation improvements. More than 75 percent of voters subsequently approved a 30-year extension of Measure A, continuing this tax through 2039. STA is accountable for the responsible administration of this funding.

What It Does:

For more than 30 years, Measure A has provided local transportation funding to maintain and improve the quality of life in Sacramento County utilizing the following principles:

- To reduce traffic congestion

- To improve air quality

- To maintain and strengthen the county’s road and transportation systems

- To enhance Sacramento County’s ability to secure state and federal funding by providing local matching funds

- To preserve unique, natural amenities

- To preserve agricultural land

- To serve all residents of Sacramento County.

How It Works:

Sacramento County voters, in 2004, overwhelming agreed to extend Measure A for 30 years. STA developed a expenditure plan by incorporating feedback from multiple stakeholders, such as the general public, local governments, and transportation experts. Officially titled, “The Measure A Ordinance and Transportation Expenditure Plan,” eligible expenditures were required to be incorporated into the ballot measure.

STA distributes funding per the Measure A Ordinance and Transportation Expenditure Plan to the various partner agencies based on the identified formula and/or percentages for its intended purpose.

Taxpayer Safeguards:

The half-cent retail transactions and use tax is statutorily dedicated for transportation in Sacramento County. It cannot be used for other governmental purposes or programs.

There are specific provisions in the Ordinance to ensure that funding from the tax is used in accordance with specified voter-approved transportation project improvements and programs. These safeguards include:

- The Expenditure Plan can only be changed with approval by the Sacramento County Board of Supervisors and a majority of all cities in the County representing the incorporated population.

- Creating an ongoing Independent Taxpayer Oversight Committee to supervise fiscal and performance audits regarding the use of all sales tax funds.

- Measure A funds can only supplement existing local revenues being used for transportation and shall not be used to replace existing road funding programs or to replace requirements for new development to provide for its own road needs.

- Seeking maximum funding for transportation improvements through state and federal programs. The Sacramento Transportation Authority does not provide transactions and use tax revenue to any city or to Sacramento County unless all transportation revenues currently used by that jurisdiction continue to be used for transportation purposes.

- Guaranteeing that no more than three quarters of one percent of the available funds are expended on administration of the sales tax program.

- Requiring a mandatory Expenditure Plan review every 10 years to make certain that the program reflects demographic, economic, and technology change needs. The most recent Decennial Review was approved and adopted in June 2021.

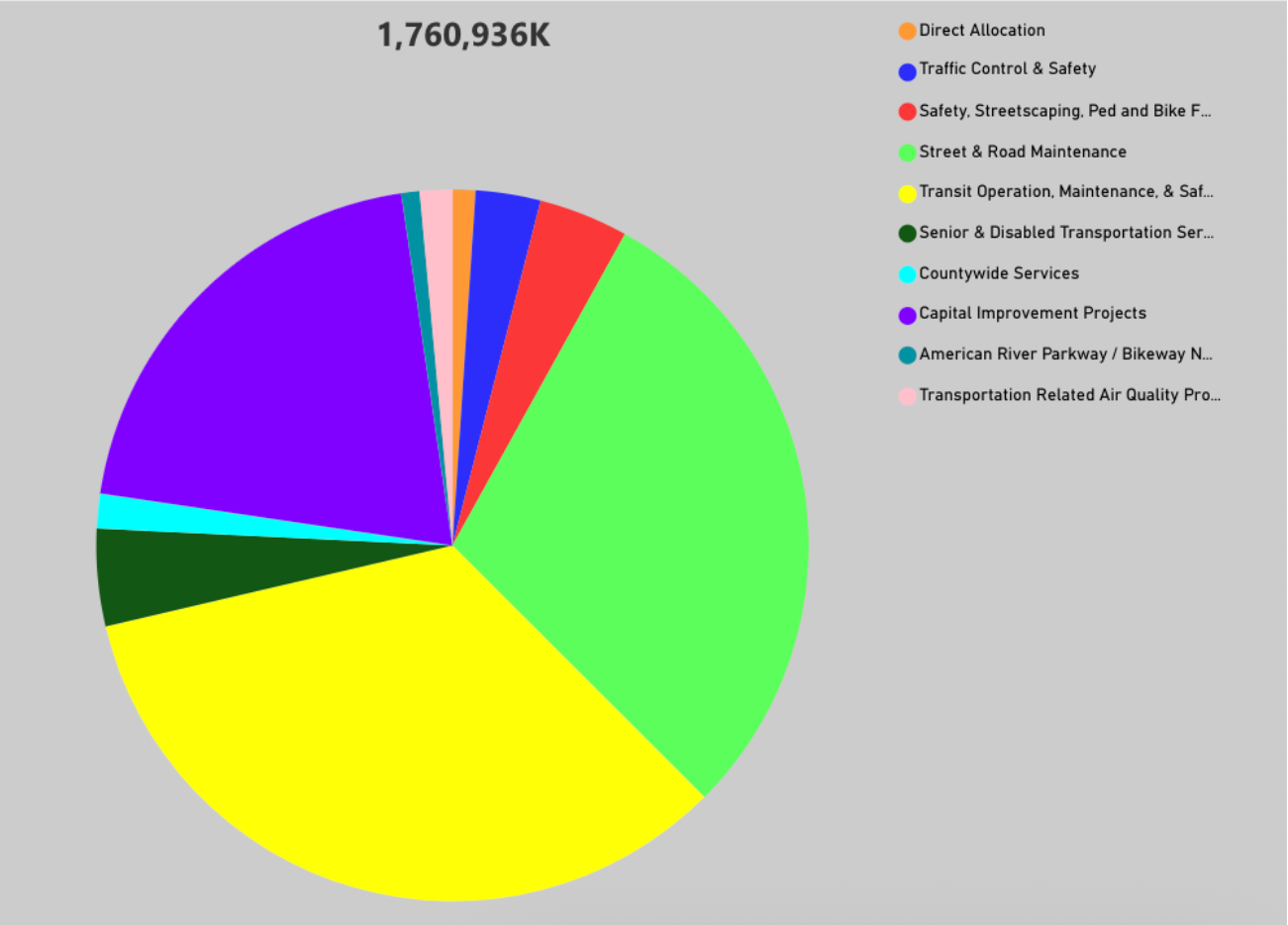

Distribution

Measure A provides for amounts that pass directly to jurisdictions based on formulaic calculation based on the ordinance. These funds amount to nearly 80% of the Measure. To present these in a way that is understandable and actionable a Microsoft PowerBI dashboard was created. For more information regarding the Quarterly Measure A Tax Distributions click here.

Definitions of the funding programs are listed below.

Direct Allocation:

The Cities of Galt & Isleton receive allocations of the sales tax revenues collected.

Traffic Control & Safety:

This program will fund traffic control system improvements, high priority pedestrian and vehicle safety projects, and emergency vehicle preemption systems for quicker police, fire and ambulance response throughout Sacramento County.

Safety, Streetscaping, Ped and Bike Facilities:

This program will fund non-motorized, pedestrian and bicycle safety improvements.

Street & Road Maintenance:

This program will fund city street and county road maintenance.

Transit Operations, Maintenance & Safety:

Allocates supplemental funding for the operation and maintenance of transit services to ensure their continued efficiency and safety.

Senior & Disabled Transportation Services:

Allocation of funding to directly support the Consolidated Transportation Services Agency in the county that coordinates transportation options for easier access by seniors and individuals with disabilities.

Countywide Services:

This encompasses the Neighborhood Shuttle Program, providing needed Microtransit services to populations in need, and STA administrative allocation.

Capital Improvement Projects:

American River Parkway / Bikeway Network:

Funding is provided to support the maintenance and improvement of the extensive parkway trail system in the County of Sacramento.

Transportation Related Air Quality Program:

Funds projects and programs that assist with meeting state and federal air quality mandates for mobile sources and to environmentally mitigate for transportation capital improvements in the Expenditure Plan.

Transportation Mitigation Fees

What is it?

One component of Measure A was the introduction of a county-wide transportation mitigation fee so that no revenue generated from the tax shall be used to replace transportation mitigation fees required from new development. This was enacted by the STA Board in Section VII of STA Ordinance 04-01. The stated goal was, “To develop and implement a uniform transportation mitigation fee on all new development in Sacramento County that will assist in funding road and transit system improvements needed to accommodate projected growth and development.” The creation of the fee was approved by voters with the extension of Measure A in 2004. The Measure A sales tax extension Transportation Mitigation Fees went into effect on April 1, 2009.

How are the Fee’s Spent?

The Transportation Mitigation Fees are allocated as follows:

- 35% Local streets and roads for capital improvements.

- 20% Public transit for capital improvements.

- 20% Local interchange upgrades, safety projects and congestion relief improvements on the local freeway system, including bus and carpool lane projects.

- 15% Smart Growth Incentive Program

- 10% Transportation Project Environmental Mitigation